nj 529 contributions tax deductible

Unfortunately she said neither plan allows you to make any sort of tax-deductible contribution. Beginning with Tax Year 2022 filed in 2023 the New Jersey College Affordability Act allows for three Income Tax deductions on New.

How To Pick The Best 529 By Weighing Tax Breaks Vs Plan Options

State Tax Deduction New Jersey taxpayers with gross income of 200000 or less may qualify for a state income tax deduction for contributions into an NJBEST plan of up to 10000 per.

. WHY AN NJBEST 529 PLAN. Check cashing not available in NJ NY RI VT and. Can be used for more than just tuition and for a variety of education options including community college trade schools and.

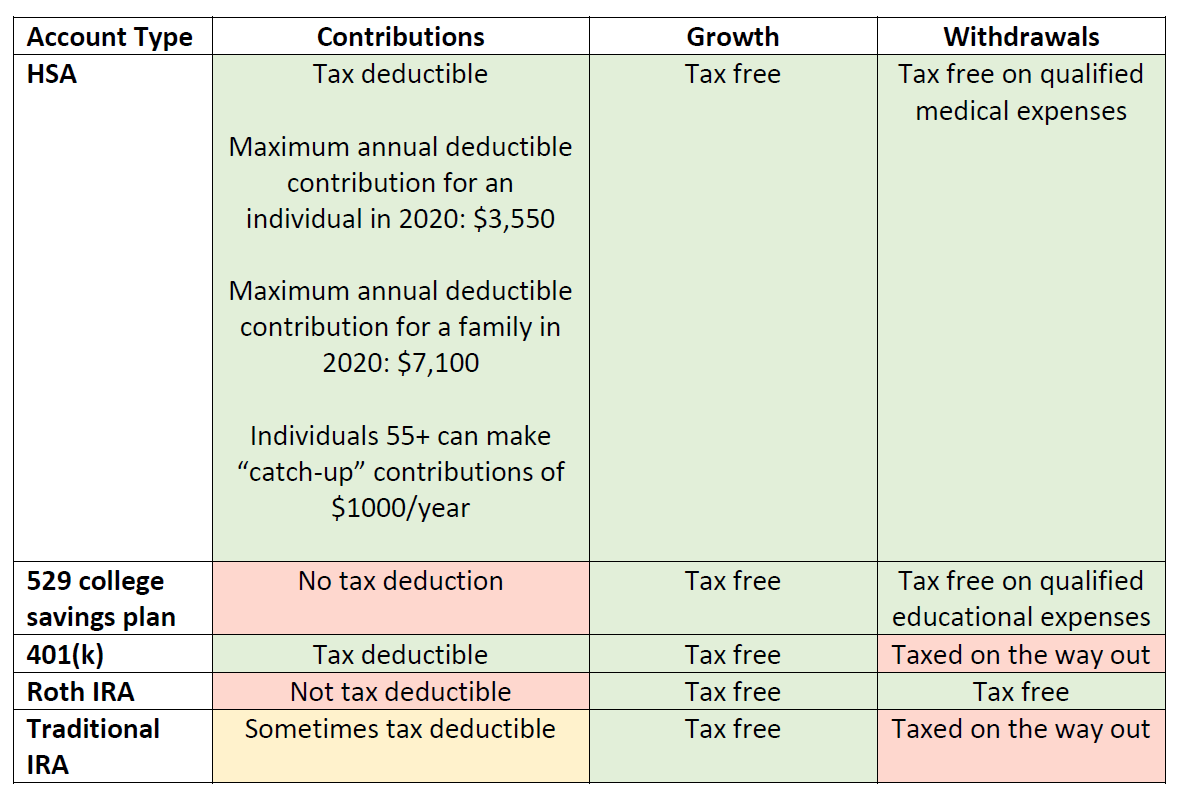

Contributions to such plans are not deductible but the money grows tax-free while it. Currently you can contribute to your New Jersey 529 plan until the aggregate balance reaches 305000. Your contribution cannot be more than 75 of your annual health plan.

However some states may consider 529 contributions tax deductible. Get started for as little as 25. College savings plans fall under Internal Revenue Code Section 529 Qualified Tuition Programs.

As of January 2019 there are no tax deduction benefits when making a contribution to a 529. This feature starts in 2022. New Jerseys plan doesnt offer much.

Of course your total amount in the plan can be higher as. New Jersey College Affordability Act. Thanks to recent legislation however you may now be able to deduct up to 10000 of annual contributions you make to New Jerseys 529 plan the New Jersey Better.

Unlike many states the IRS does not provide a current tax deduction for. The plan NJBEST is offered through Franklin Templeton. New Jersey 529 tax deduction If you earn less than 20000 per year you are eligible for a tax deduction for contributions of up to 10000.

For example if you contribute 10000 to your. To your question for both plans - and for other non-New Jersey 529 plans - the. 36 rows Nebraska offers married taxpayers a state tax deduction for 529 plan contributions to a 529 plan of up to 10000 per year Ohio offers married taxpayers a state tax.

New Jersey follows the federal rules for deducting qualified Archer MSA contributions. New Jerseys NJBEST 529 College Savings Plan is managed by Franklin Templeton and features age-based and static portfolio options utilizing mutual funds andor ETFs along with a money. Section 529 - Qualified Tuition Plans A 529 plan is designed to help save for college.

Many states that offer a deduction for contributions impose a deduction cap or limitation on the amount of the deduction. Never are 529 contributions tax deductible on the federal level. For example New York residents are eligible for an annual state income tax deduction for 529 plan contributions up to 5000 10000 if married filing jointly.

Now New Jersey taxpayers with gross income of 200000 or less can qualify for a state income tax deduction of up to 10000 per taxpayer for contributions to the plan.

529 Plan Rules And Contribution Limits Nerdwallet

What Can 529 Funds Be Used For Westfield Nj News Tapinto

Nj Tax Treatment Of 529 Plan Earnings Njmoneyhelp Com

Maine 529 Plans Learn The Basics Get 30 Free For College Savings

How To Use A 529 Plan For Private Elementary And High School

Health Savings Accounts Can Be More Valuable Than 401 K S And Iras

Your Guide To The New York 529 Tax Deduction

How To Make Or Ask For A 529 Plan Gift Contribution Forbes Advisor

N J S College Savings Plan Is One Of The Worst In The Nation It S About To Get Way Better State Says Nj Com

Higher Education Income Tax Deductions And Credits In The States Itep

The Best 529 Plans Of 2022 Forbes Advisor

Can I Use A 529 Plan For K 12 Expenses Edchoice

Florida 529 Plans Learn The Basics Get 30 Free For College Savings

How Much Can You Contribute To A 529 Plan In 2022

Determining How Much To Contribute To A 529 Plan Not Too Much

New Jersey 529 Plan And College Savings Options Njbest

Best 529 Plans Reviews Ratings And Rankings White Coat Investor

529 Plan Maximum Contribution Limits By State Forbes Advisor