arizona solar tax credit form

We will update this page with a new version of the form for 2023 as soon as it is made available by the Arizona government. According to our market research and data from top solar brands the average cost of solar panels in Arizona is 261 per watt of solar capacity which means a 5-kW system costs around 13050 before incentives.

How The Solar Tax Credit Works Youtube

The federal solar tax credit gives you a dollar-for-dollar reduction against your federal income tax.

. 1 Best answer. Include Forms 301 and 310 with your tax return to claim this credit. States often have dozens of even hundreds of various tax credits which unlike deductions provide a dollar-for-dollar reduction of tax liability.

If you install your photovoltaic system in 2020 the federal tax credit is 26 of the cost of your solar panel system. Owners of new residential and commercial solar can deduct 26 percent of the cost of the system from their taxes. Form 301 and its instructions for all relevant tax years can be found at.

If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200. Here are the specifics. Part-Year Resident Personal Income Tax Return Non-calculating fillable Tax Credits Forms.

Arizona Department of Revenue 1600 W. Pub 542 from the Arizona Department of Revenue includes some frequently asked questions that arent covered in the instructions for Form 310. Find Arizona Solar Prices By Zip.

To claim this credit you must also complete Arizona Form 301 Nonrefundable Individual Tax Credits and Recapture and include both forms with your tax return. Arizona just like the federal government is offering an income tax credit for switching to a solar energy system. If you have any further questions regarding taxes consult a tax professional.

It is a 25 tax credit on product and installation for both 2020 through 2023. You can claim the credit on Form 310. This is a personal solar tax credit that reimburses you 5 of the cost of your solar panels up to 10001000 maximum credit per residence irrespective of the number of energy devices installed.

More about the Arizona Form 310 Tax Credit We last updated Arizona Form 310 in March 2022 from the Arizona Department of Revenue. The Arizona tax credit for solar panels is 25 of your systems installed costs or 1000 whichever amount is less. However unlike the federal governments tax credit incentive Arizona tax credits have a limit.

Starting in 2020 the value of the tax credit will step down to 26 and then again to 22 in 2021. Monroe Phoenix AZ 85007-2650 602 255-3381 800 352-4090 Web Site. This means that in 2017 you can still get a major discounted price for your solar panel system.

If you are installing solar yourself you dont need such a certificate but your solar energy device must meet the required criteria. We last updated Arizona Form 344 from the Department of Revenue in May 2021. 26 rows Property Tax Refund Credit Claim Form -- Fillable.

Neither Solar Concepts Redilight QuietCool or any product manufacturers are tax consultants. Applications must be submitted between January 2 and January 31 of the following calendar year of production. Form 344 is an Arizona Corporate Income Tax form.

June 6 2019 1029 AM. Their tax credit incentive will let you deduct 25 of the cost of your solar energy system from your state income taxes. Wwwazdorgov Arizona Credit for Solar Hot Water Heater Plumbing Stub Out and Electric Vehicle Charging Station Outlet.

Ad Free Arizona Solar Quotes. This is claimed on Arizona Form 310 Credit for Solar Energy Devices. Nonrefundable Corporate Tax Credits and Recapture.

Federal Solar Investment Tax Credit ITC Arizona Residential Solar Energy Tax Credit Energy Equipment Property Tax Exemption Solar Equipment Sales Tax Exemption Were One of the Best Solar Installers in Arizona On top of all these solar incentive programs our solar plans and home battery services in Arizona start at 0 down. This is 26 off the entire cost of the system including equipment labor and permitting. Equipment and property tax exemptions Thanks to the Solar Equipment Sales Tax Exemption you are free from the burden of any Arizona solar tax.

This incentive comes right off of your income tax for the same year you install the solar system. The 30 tax credit applies as long as the home solar system is installed by December 31 2019. Ad Find The Best Solar Providers Servicing Your Area See 6489 Reviews Now.

Applications not submitted in January will not be accepted. Arizona has the Arizona Solar Tax Credit. This information is provided as general knowledge.

Discover Local Solar Pros In Arizona Today. Residential Arizona Solar Tax Credit. The tax credit remains at 30 percent of the cost of the system.

Your solar installer needs to provide a certificate stating that the solar energy device complies with Arizonas solar energy device requirements. This form is for income earned in tax year 2021 with tax returns due in April 2022. Get Arizona Solar Panel Quotes.

Phoenix AZ Homeowners who installed a solar energy device in their residential home during 2021 are advised to submit Form 310 Credit for Solar Energy Devices with their individual income tax return and Form 301 Nonrefundable Individual Tax Credits and Recapture. Approval and certification from the Arizona Department of Revenue is required prior to claiming the tax credit. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system.

The form is just one page and the instructions contain details about how to claim it.

2022 Arizona Solar Incentives Guide Tax Credits Rebates More

Arizona Solar Incentives Arizona Solar Rebates Tax Credits

2022 Arizona Solar Incentives Guide Tax Credits Rebates More

Everything You Need To Know About The Solar Tax Credit Palmetto

Back To Back Sun Storms May Supercharge Earth S Northern Lights Space And Astronomy Earth And Space Science Astronomy

Solar Tax Credit Details H R Block

Pricing Incentives Guide To Solar Panels In Arizona 2022 Forbes Home

Arizona Solar Everything You Need To Know Understand Solar

Image Credit Copyright Adam Block Mount Lemmon Skycenter University Of Arizona Http Skycenter Arizona Edu Gallery Galaxie Spiral Galaxy Galaxy Art Galaxy

2022 Arizona Solar Incentives Guide Tax Credits Rebates More

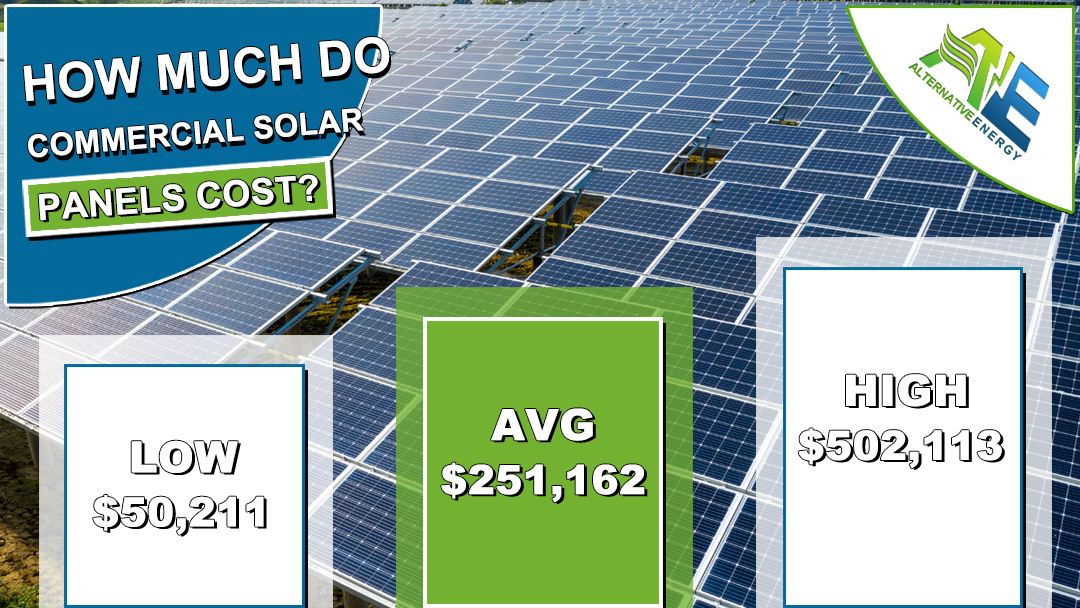

Commercial Solar Panels Cost 2021 Average Prices

Free Solar Panels Arizona What S The Catch How To Get

The Extended 26 Solar Tax Credit Critical Factors To Know

Sample Construction Contract Check More At Https Nationalgriefawarenessday Com 26825 Sample Construction Con Construction Contract Contract Contract Template